Calm Capital: Stoic Confidence in Turbulent Markets

Principles Before Profits: A Stoic Investor’s Groundwork

Rituals That Reduce Panic During Swings

Taming Biases with Clarity and Courage

Lessons Etched by Crashes and Recoveries

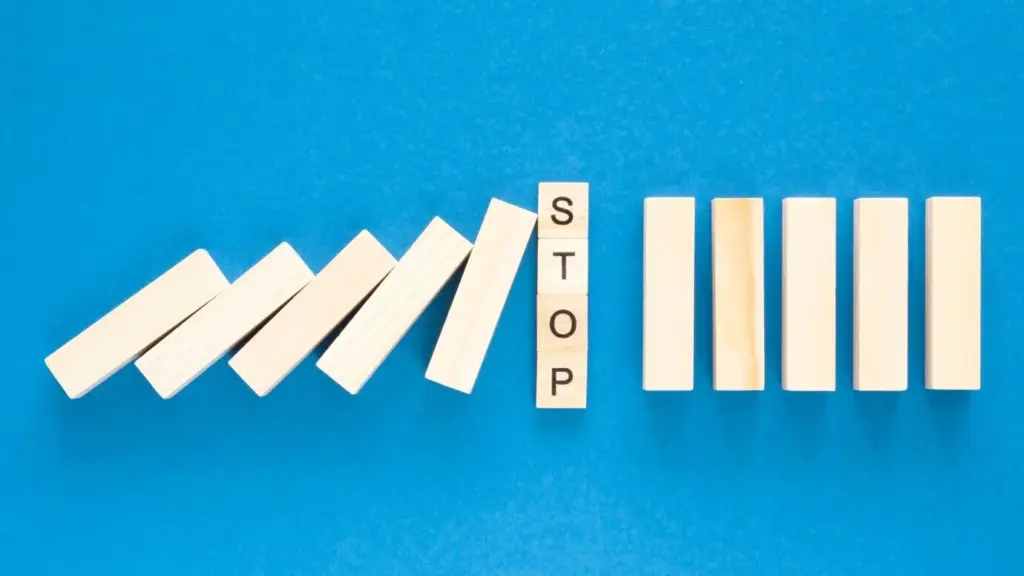

Designing a Portfolio You Can Hold Through Storms

Match Allocation to Real Life, Not Dreams

List obligations, income stability, emergency reserves, and timelines for major goals. Match equity exposure to real capacity for loss, not wishful return targets. When allocation reflects reality, drawdowns feel tolerable, decisions slow down, and compounding remains uninterrupted through storms that once would have rattled nerves and plans.

Simplicity Beats Complexity When Nerves Are Frayed

List obligations, income stability, emergency reserves, and timelines for major goals. Match equity exposure to real capacity for loss, not wishful return targets. When allocation reflects reality, drawdowns feel tolerable, decisions slow down, and compounding remains uninterrupted through storms that once would have rattled nerves and plans.

Guardrails, Bands, and Buckets

List obligations, income stability, emergency reserves, and timelines for major goals. Match equity exposure to real capacity for loss, not wishful return targets. When allocation reflects reality, drawdowns feel tolerable, decisions slow down, and compounding remains uninterrupted through storms that once would have rattled nerves and plans.